What a Huge Walmart Mistake Can Teach Us About Product Pricing

Plus: Tactics you can use to make your product an impulse purchase without lowering your price

Imagine you’re doing some early Christmas shopping when you come across the following offer for a TV:

That’s exactly what happened to several women in the Dallas-Forth Worth area one Black Friday in 2016. As you might expect, the women quickly placed orders. One woman even ordered two 40-inch TVs and a 75-inch TV.

In a moment, I’ll tell you what happened next. But first, let’s talk about what was going on in these women’s minds. As it happens, we don’t have to guess. The lady who ordered three TVs told her local NBC affiliate:

“I didn’t even intend to buy a TV … I bought a TV because I was like, ‘I'm stupid if I don’t.’”

That, friends, is the very essence of the fourth criterion on my Divine Seven (D7) checklist. How do you know if a product you like can be PRICED RIGHT? The best answer is that you think it can be priced in such a way that people will feel stupid if they don’t buy it.

Now that’s a pretty high bar, I admit. When I first added this criterion to my list, satisfying it wasn’t quite that extreme. It really just meant a product should be able to sell for $20 or less. Why? Because $19.99 was a magic price point for us. We had discovered that at or below that number, people didn’t think much before buying. In other words, it was the impulse-price limit for DRTV. Anything above it fell into ‘considered purchase’ territory, which is the last place any DR marketer wants to be. ‘Considering’ (i.e. thinking before buying) is a well-known conversion killer.

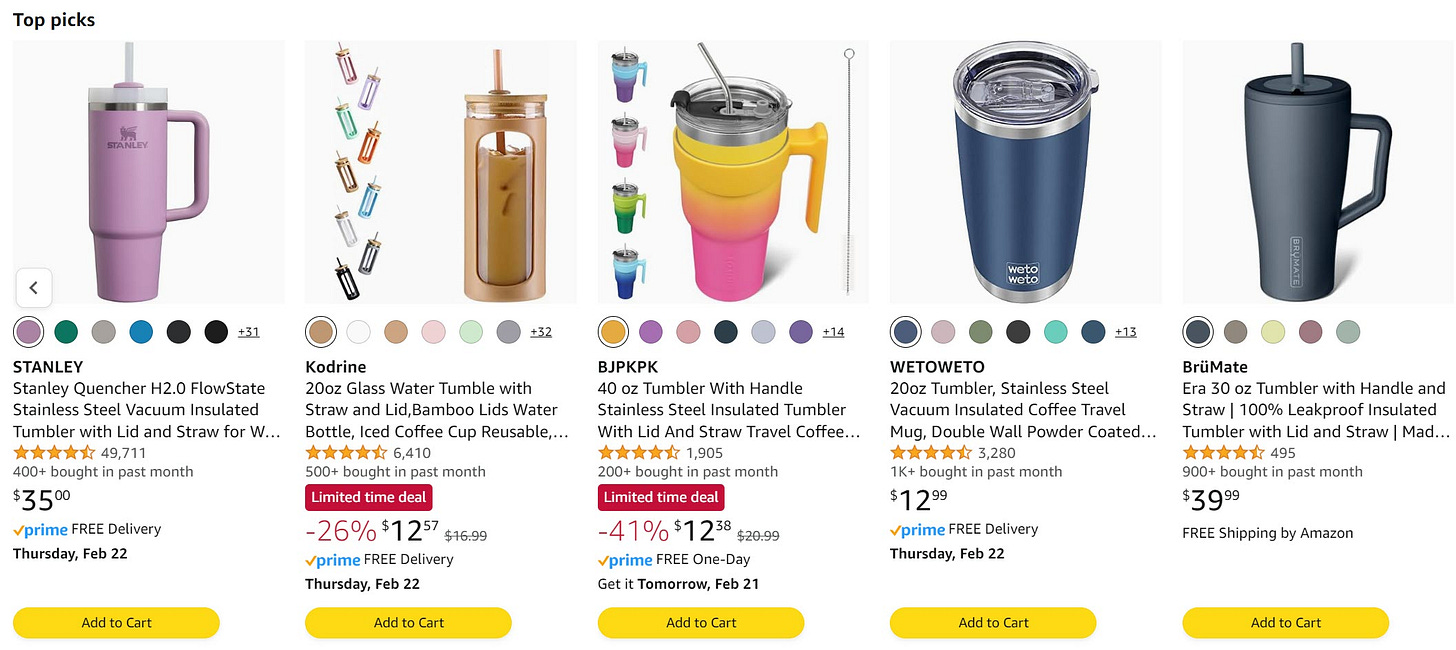

After some time, our industry came to believe that our magic number had moved north to $29.99, perhaps even further. Today, I’m really not sure where I would draw the line. I mean, what does ‘priced right’ even mean in a world where every Amazon search result looks something like this?

That brings me back to the story about the Black Friday 2016. What really drove those women to buy is something we call “price-to-value.” It’s the key to what drives impulse purchases. It asks: How does your price compare to the perceived value of your product? If it’s lower than what people expect, you’re creating an impulse to buy. If it’s significantly lower, like $99 for a TV, that impulse might be impossible to resist.

Speaking of Black Friday, if you pair this effect with FOMO triggers such as limited-time deals, it intensifies. (More on this below.) However, you should know that language alone can’t create a strong impulse to buy — which is why I made PRICED RIGHT part of my earliest considerations. It’s something to think about before you give a product idea the green light. If there’s no chance you can achieve anything like a compelling price, you might want to think again.

By the way, the rest of the story is that the $99 TV orders were all rejected. According to Money magazine, Walmart first claimed the women had canceled the orders themselves. Later, they admitted it was as a pricing error and apologized, offering the women $10 gift cards (eventually upgraded to $25 gift cards) for their trouble.

Money’s takeaway was that consumers should understand that some deals are just too good to be true. I’m not so sure about that. I bet consumers already know this. I think these women knew it. They were just powerless to pass up a deal that good. Hey, it was worth a shot!

At this point, you may be thinking: Cute story. Interesting concept. But what if I already have a product and can’t do crazy things with my price?

I’m glad you asked and, may I say, your skepticism is entirely justified. Walmart couldn’t actually sell TVs for $99, after all. Likewise, it’s unlikely you can go low enough with your pricing to make buying your brand a ‘no-brainer’ and yet still make a decent profit.

One solution is to craft an offer (or “bundle” if you prefer) around the product that jacks up its perceived value. Here’s a recent DRTV example that I’ve shared before:

This is what I call a ‘kitchen sink offer’ because they throw in everything but …

What’s especially great about this approach is that it defies simple price comparisons. That is, it’s pretty easy to compare one set of pans with another. But it’s not so easy to compare different pan offers; e.g. pans that comes with a free knife set and a high-value additional pan. Pepper in some of the advanced marketing techniques you saw above (slashing the price, dropping a payment), and you can turn even a modest price-to-value into a “stupid if I don’t” type deal.

Another tactic is something you also saw in the Armor Max commercial called “anchoring.” According to Harvard Law School’s Program on Negotiation:

The anchoring effect is a cognitive bias that describes the common human tendency to rely too heavily on the first piece of information offered (the “anchor”) when making decisions. During decision making, anchoring occurs when individuals use an initial piece of information to make subsequent judgments. Once an anchor is set, other judgments are made by adjusting away from that anchor, and there is a bias toward interpreting other information around the anchor. For example, the initial price offered for a used car sets the standard for the rest of the negotiations, so that prices lower than the initial price seem more reasonable even if they are still higher than what the car is really worth.

Amazon has built anchoring into almost every price they list, like so:

Can just giving someone a comparison price set an anchor? It sure can. We do it all the time. We call it a “value comparison.” Here’s an example from my own work:

To be fair, there’s a bit more substantiation in there than a crossed-out “list price.” I used a real product page I found online. But does that matter? No, it does not. The anchoring effect is so fast and subtle, it’s often beneath the level of conscious thought. Moreover, even if people do scoff at your comparison — the anchor is still set. Repeated experiments and real-world sales results have demonstrated this again and again. Just ask Jeff (Bezos, that is).

Here’s a more recent example of a value comparison from a commercial that’s still in the DRMetrix top 30 after three months on the air:

By the way, remember when I told you that certain phrases can intensify the FOMO effect of a solid price-to-value? Let us count the many triggers embedded in this offer:

Order in the next five minutes for an instant $10 discount

Last chance: Rising costs

Supply-chain shortages

Strict limit of 3 per order

Must act fast, don’t wait

Perhaps you think these tactics are a little too ‘hard sell’ for your brand. That’s fine. But can’t you feel the pull of a well-anchored price combined with a strong sense of urgency? It’s darn near wizardry!

An Unbelievable Deal!😲

Last year, I added 84 new commercials to the The Library of DRTV. This year, I’ve already added another dozen. These commercials were created by direct-response marketing geniuses who have developed reliable techniques for generating millions of dollars in sales. Studying their commercials would teach you more about marketing than any MBA — and that’s on top of the MBA-quality content you’re getting each week in your inbox. Support me by becoming a paid subscriber, and I’ll give you immediate access to this valuable archive of additional content.

It gets better. According to Forbes magazine, the average cost of an MBA is $30,900 per year. But a year of premium access to this publication won’t cost you tens of thousands of dollars. In fact, it won’t cost you $1,000. Or even $100. That’s because a paid subscription is just $50 per year!

Look, inflation is a real problem in America right now. You may have noticed that many of your favorite content providers have been raising the price of their subscriptions. I can’t promise I won’t have to join them soon, so take advantage today and lock in the year while my price is still this unbelievably low. Don’t delay: Click below to upgrade today!

The Divine Seven

1. UNIQUE

(Article: Build the Marketing Into Your Product to Maximize Sales)

2. MASS MARKET

(Article: These 3 Powerful Letters Can Greatly Improve Your Odds of Choosing Hit Products)

3. PROBLEM SOLVING

(Article: The Problem Scale Can Guide You Toward the ‘Heart Attack’ You Seek)

4. PRICED RIGHT

(Article: What a Huge Walmart Mistake Can Teach Us About Product Pricing)

5. EASILY EXPLAINED

(Article: Never Try to Sell a ‘Swiss Army Knife’)

6. AGE APPROPRIATE

(Article: Why TikTok Advertisers Shouldn’t Sell Canes)

7. CREDIBLE

(Article: Don’t Even Bother With Products That Can’t Live Up to the Hype)