Why TikTok Advertisers Shouldn't Sell Canes

And other, less obvious insights into product-media fit

Here’s a short quiz to test your marketing intuition.

What age group:

Watches the most traditional (broadcast and cable) TV?

Is most likely to use online streaming to watch TV?

Is most likely to be watching YouTube? How about least likely?

Is most and least likely to be using Facebook?

Is most and least likely to be using TikTok?

Spends the most?

Before I reveal the answers, let me share a quick story that explains why you should care about these demographics.

About five years into my direct-marketing career, I had a realization: One group of people mattered more to me than any other — and it wasn’t even close. That group? Old people. More precisely, people age 50 and above; i.e. Baby Boomers and seniors. No other demographic was nearly as important. These folks were the whole game.

And then I realized this was true of my entire industry.

As the name suggests, the ‘As Seen on TV’ industry relies heavily on TV viewers. Actually, we relied on cable TV buyers back then; i.e. people who bought our products right after watching our commercials. Even though 80-90% of our sales were ultimately transacted at retail stores like Walmart, these direct-to-consumer sales were the foundation of the entire enterprise. For one thing, products never even made it to retail if the commercial didn’t generate strong direct sales. For another, we depended on the advertising ‘subsidy’ that direct sales provided. If TV viewers didn’t keep buying, we couldn’t keep advertising and our products would die on the shelf for lack of support.

In other words, a product that did not appeal to the core demographic that bought off TV had no real chance of succeeding, and that core demographic was, in a word, old. While the big brands were all obsessed with younger consumers, I realized it was the old folks watching the cable networks that needed to be our obsession. Those were the people calling our 800 numbers and visiting our websites.

“The median age of a linear television viewer is 55 years old. Cable-news viewership is even older; on MSNBC, it was 68 years old in 2021, while CNN’s median age was 64 years old.”

Source: Marketing Brew

This conclusion led to a resolution: I would no longer pursue products that did not have a strong appeal to old folks — and that’s how the sixth of my Divine Seven (D7) criteria came to be. I referred to it as making sure a product was AGE APPROPRIATE.

We typically think of this phrase in the context of entertainment (e.g. “young kids should only watch movies that are age appropriate”). Sometimes we also use it in the context of fashion (e.g. “that woman should really wear clothes that are a little more age appropriate”). In this context, it means something roughly similar. It means sellers should only choose products that are appropriate for the age of the people mostly likely to view their dominant advertising medium. (That last phrase is key.)

With this in mind, here are the answers to the quiz above:

Today, the people who watch traditional TV skew even older than when I first had my realization. Adults 65+ now account for 60% of all time spent watching broadcast and cable channels, according to MarketingCharts.com.

On the other hand, it’s young adults (age 18-29) who are the most likely to use online streaming to watch TV, according to Pew Research. About 61% of this group primarily uses streaming.

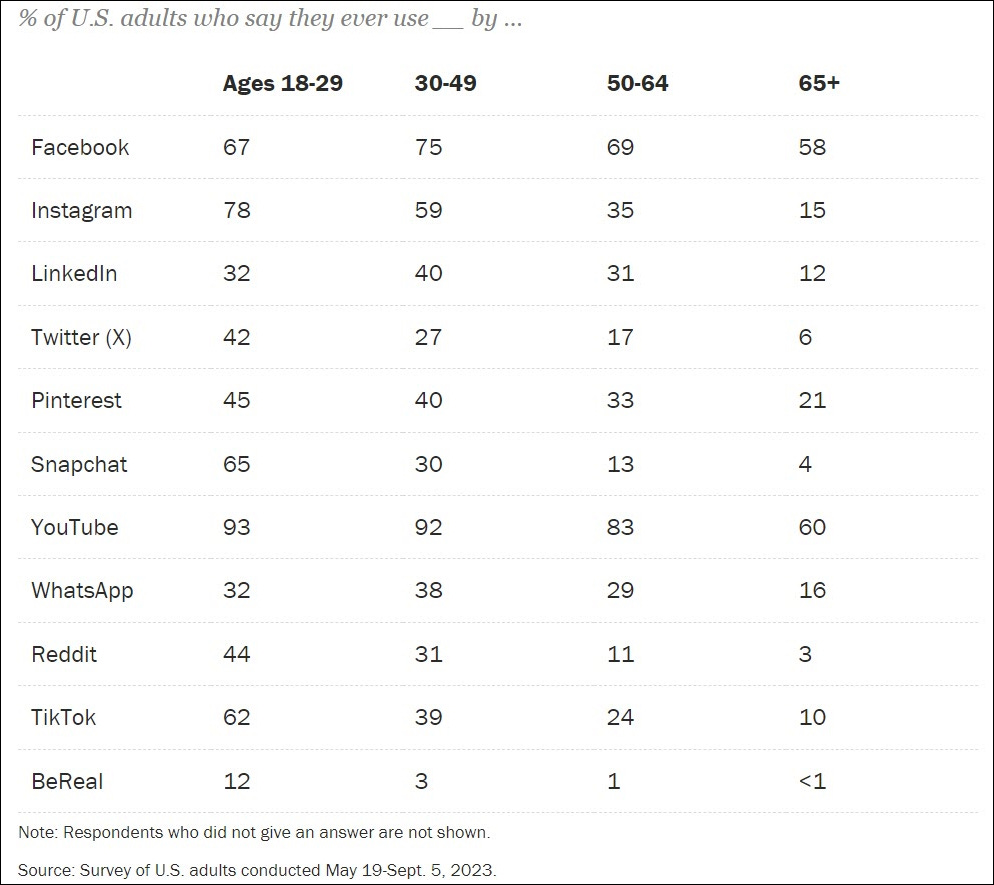

Young adults are also the most likely to be watching YouTube (at 94%), according to Pew. However, middle-age adults (30-49) are right behind them (at 92%), and even older adults 50-64 (83%) watch YouTube. The least likely to be watching YouTube are seniors (65+) — although many still watch it (60%).

Middle-age adults (30-49) are the most likely to use Facebook (at 75%), per Pew. Here again the 65+ demographic is the least likely user (at 58%).

Unsurprisingly, Pew finds young adults (18-29) are the most likely to use TikTok (at 62%). More than half of adults 18-36 use it. Only 10% of those 65+ ever use it.

“People over age 50 are responsible for more than half the consumer spending in the United States,” according to the AARP Media Advertising Network.

Here’s how my D7 lens would have you interpret these statistics:

If you rely on traditional TV as the key driver of your critical sales (as we did), your AGE APPROPRIATE product will appeal to adults 65+.

Conversely, if TikTok is your platform of choice, go the other way entirely and pick products that appeal primarily to youngsters.

Rely on Facebook advertising? Make sure your products appeal to middle-age folks.

Also: YouTube has the most flexibility in this regard, and traditional TV is what people who spend the most are watching!

This way of looking at things may seem counter-intuitive. Not the part about cable TV being for older folks or kids loving TikTok — everyone knows that. It’s the part about choosing products based on media. That’s going to seem backward to many, and I admit the ‘As Seen on TV’ business is somewhat unique in this regard. Again, we put the medium right in the name. And yet, I suspect other types of DTC sellers have a similar focus that just isn’t so obviously stated. That is, I bet many marketers are in the ‘As Seen on Facebook’ business, or ‘As Seen on TikTok’ business, and don’t even fully realize what that means.

One last thing: It’s definitely possible to over-interpret this sort of data. Remember, these are not hard-and-fast rules. The D7 is only about increasing your odds of success.

With traditional TV, I learned that despite hitting the center of the bull’s-eye, senior-only products (e.g. canes, other mobility items) generally didn’t generate enough sales to sustain a DRTV campaign. That’s because ‘not yet seniors’ and middle-aged folks were still a significant TV-watching demographic, and limiting the appeal limited my market potential.

On the other hand, I quickly put teen and ‘tween’ products in the “don’t even bother” category. They were such an insignificant demographic among traditional TV watchers that products primarily appealing to them had close to zero odds of success.

Parsing the statistics for your dominant medium should yield similar insights. Please feel free to share what you learn.

Chart Watch👁️

Balder Boss

Pitch: “Get over 60% more head coverage for a faster, closer shave”

Offer: $14.99 for a 30-day trial

Bonus: Ear, nose & brow trimmer (just pay P&H)

Brand: Remington

Marketer: Spectrum Brands

This campaign launched last week, debuting in the Top 20 of the DRMetrix report. It will compete with IdeaVillage’s MicroTouch Titanium Head Shaver, which launched last January and is currently in the Top 10.

When I wrote about head shavers last year, I expressed skepticism that the market was big enough given only about 7% of men shave their heads. IdeaVillage’s current ranking proves me wrong, and now Spectrum obviously thinks the market is big enough for two.

The Next Big Hit🤑

What’s better than learning about an exciting new category like head shavers? Learning about that category long before two powerful companies are already exploiting it. That’s one reason I created the The Library of DRTV. Each week, I update The Library with brand new commercials from the top DRTV marketers months before they roll out.

Not all of these commercials will be successful, of course, but many go on to become nationally ranked campaigns (see above). That’s why monitoring these tests is a great way to guess the future and anticipate what categories will be getting a significant advertising push in the coming months.

To get immediate access to The Library, support my work by upgrading your free subscription to paid. It costs just $5.99 per month or $59 for the year. Don’t delay: Click below to upgrade today!

News(letters) You Can Use📰

This week’s edition of Thomas McKinlay’s Ariyh (Academic research in your hands) has yet another highly useful suggestion for sellers:

Make the price of your multipacks easily divisible by the number of products in the pack (e.g. $12 for a 6-pack of soda, instead of $11) and clearly label the number of units in the bundle.

People will be more likely to buy the multipack and will be willing to pay a higher price.

Here’s the infographic:

The research cited suggests “people are up to 45% more likely to buy a multipack when the price is easily divisible by the number of items,” according to McKinlay. You can read his full report here.

The Divine Seven

1. UNIQUE

(Article: Build the Marketing Into Your Product to Maximize Sales)

2. MASS MARKET

(Article: These 3 Powerful Letters Can Greatly Improve Your Odds of Choosing Hit Products)

3. PROBLEM SOLVING

(Article: The Problem Scale Can Guide You Toward the ‘Heart Attack’ You Seek)

4. PRICED RIGHT

(Article: What a Huge Walmart Mistake Can Teach Us About Product Pricing)

5. EASILY EXPLAINED

(Article: Never Try to Sell a ‘Swiss Army Knife’)

6. AGE APPROPRIATE

(Article: Why TikTok Advertisers Shouldn’t Sell Canes)

7. CREDIBLE

(Article: Don’t Even Bother With Products That Can’t Live Up to the Hype)

Brilliant newsletter today! We continue to use magazines and newspapers in order to reach our target demographic–older folks. Direct mail is still viable across almost all the age-groups–Everyone still has a snail mail box.